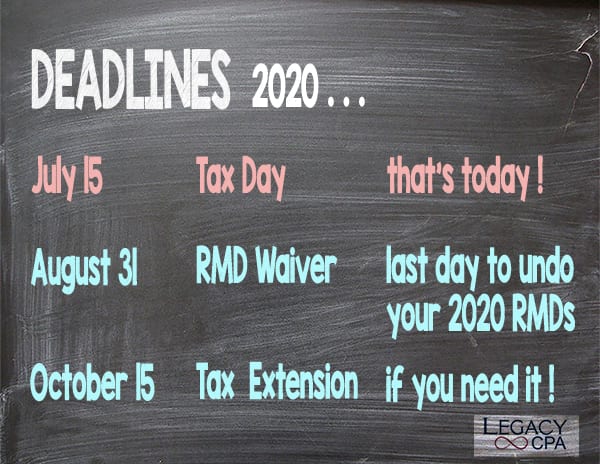

July 15, 2020 …

Tax day is finally here, July 15! If you need more time, it’s easy to get an automatic filing extension to October 15, and we can help you with that.

But, there is another deadline coming up: August 31, 2020.

For those of you who took out your 2020 required minimum distributions (RMDs) before Congress decided to waive all 2020 RMDs due to COVID-19, you have until August 31, 2020 to take action so you can also take advantage of the RMD Waiver.

2020 RMD WAIVER

The CARES Act waived all 2020 RMDs for IRAs and defined contribution plans. This waiver applies to your RMD if you:

- turned age 70.5 during tax year 2019 and had to take your first RMD by April 1, 2020, and waited until 2020 to take it;

- turn age 72 during tax year 2020 and have to take your first RMD by April 1, 2021; or

- inherited an IRA or retirement account and have to take an RMD for tax year 2020.

RELIEF PROVIDED

Let’s say you did not know about the waiver and you took your RMD. You want to put it back and avoid paying taxes on it. You have two ways to undo your 2020 RMD:

- Do an indirect rollover to another account, or

- Repay the funds to the same account.

Indirect rollover: You generally have 60 days from the distribution date to complete an indirect rollover. But in Notice 2020-51, the IRS extends this indirect rollover deadline so that you have until August 31, 2020, for RMD distributions you took earlier in tax year 2020.

As a reminder, you can’t do an indirect rollover from an inherited non-spousal IRA. Instead, to avoid being taxed on your RMD, you have to use the repayment method.

Repayment: You can repay the RMD to the original account by August 31, 2020, and pay no tax on it. And when you make this repayment under Notice 2020-51, it doesn’t count as the “one” indirect rollover per year that you can use.

Important note: These rules apply only to RMD amounts distributed (taken out of the IRA). Any amounts you took out exceeding your RMD amount aren’t eligible for relief.

Let’s say, Waldo had a $4,000 RMD requirement for his traditional IRA for tax year 2020 and took out $5,000 on January 15, 2020.

Waldo has two options:

- he can put $4,000 in another traditional IRA by August 31, 2020, or

- he can put $4,000 back into the same traditional IRA by August 31, 2020.

In either scenario, Waldo must pay tax on the $1,000 he took above and beyond his RMD amount.

(541) 326-0993