Blog

Latest Posts

Merry Christmas!

This past year has been most interesting and as it rolls to an end, we want to take this opportunity to thank every one of you. We are thankful for the chance to serve you. Regardless of what else is to come our ways, Charlie Brown said it best: "Keep looking up,...

Thinking of Moving to a Less Scary State? Think Taxes …

October 14, 2020 ... You’re thinking it’s time to move to a less scary state. You throw the kids, the critters and of course, grandma in the car and off you go to where the grass is greener. Perhaps taxes are not the first thing you consider when deciding to move to a...

The Unpardonable Sin in an IRS Audit

September 30, 2020 ... What is the unpardonable sin in an IRS audit? Suppose you just received that lovely letter from the IRS telling you that you are the subject of an IRS audit. What one record receives special attention? What one record can create a...

IRS TAX RELIEF – OREGON

September 20, 2020 ... On Wednesday, the IRS announced tax relief for Oregon wildfires and straight-line wind victims.* We pray you are one of the fortunate ones spared. Unfortunately, some of our clients lost their homes and businesses. If you ask what...

Checklist for Small Businesses Impacted by Natural Disasters

September 14, 2020 ... Natural disasters strike when least expected, just like the wild fires we saw this past week. Entire cities wiped out within minutes, businesses lost. It’s painful, unimaginable and just not right. For small business owners, natural disasters...

IRS Stops Sending Unpaid Taxes Notices Due to Backlog

August 27, 2020 ... If you mailed in your taxes and still got a letter from the IRS that you haven’t paid, no need to panic, there is a reason. Since the outbreak of Covid-19, the IRS is sitting on a backlog of millions of pieces of unopened mail. Just last Friday,...

Working at Home? Don’t Overlook These Deductions

August 7, 2020 ... Whether you claim a business office in the home or are simply working at home, say because of COVID-19, you likely have some former personal assets that you now use for business. If you thought new tax deductions, bingo! Say you don’t claim a...

PPP Loan Forgiveness Clarified for the Self-Employed

July 24, 2020 ... How much is clarity worth? And how much is making things easier worth? A whole lot! We now have both the new (a) clarity and (b) easy road to Paycheck Protection Program (PPP) loan forgiveness for the self-employed with no employees. Get ready to...

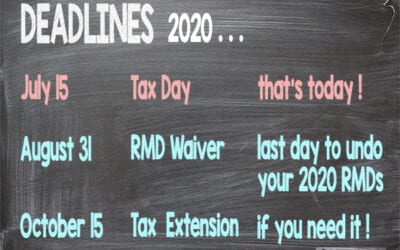

August 31: Last Day to Undo Your 2020 RMDs

July 15, 2020 ... Tax day is finally here, July 15! If you need more time, it's easy to get an automatic filing extension to October 15, and we can help you with that. But, there is another deadline coming up: August 31, 2020. For those of you who took out your...

Strategy: Hire Family to Create Tax Benefits

July 9, 2020 ... As you know and have likely experienced, many small businesses have been hurt by the COVID-19 crisis. Making smart moves right now can help ensure you emerge from the COVID-19 crisis and its aftermath a winner. In this article, we explain why one...

Tax Notes: Tax Day Around the Corner

July 2, 2020 ... We wish you a happy Fourth of July and as we celebrate Independence Day with BBQs, fireworks, family and friends, let's remember the words of Oliver Wendell Holmes, "One flag, one land, one heart, one hand, One Nation evermore!" Ours is the...

PPP Loan Deadline: June 30, 2020

June 23, 2020 ... If your business is struggling and you didn't apply for the Paycheck Protection Program (PPP) loan, there is still some time. The application deadline for the PPP loan is June 30, 2020. And, as of last Tuesday, some $130 billion in PPP loans...