Cash Flow Management

What is cash flow management and how can it help my business?

Cash flow management is the way that you track and manage money coming in and out of your business. By keeping tabs on when and where cash will be needed and projecting how much money will be available for expenditures in the future, you can make decisions that affect your business with a clear plan.

Benefits of cash flow management services:

Plan for the future—avoid getting caught off guard by expenses that you don’t have the cash to pay for.

Get paid—getting accounts receivables taken care of quicker allows for a better cash stance.

Get your money to work for you—don’t let your cash sit idly doing nothing.

Get loans you need—having a positive cash flow will help you qualify for loans if you need them.

Cash Flow Management Services

Our cash flow management services will help you conquer cash worry once and for all. We help you identify your cash needs with a solid understanding of when and how they will occur, as well as help you find the right banking partner when that crash crunch occurs. We can recommend companies that we’ve worked with in the past and that we know can help you with your unique needs.

Here’s how we help take care of your cash flow concerns:

Analyze current cash flow. We look at what is happening currently and what has happened in the past with the money flowing in and out of your business.

Forecast by make projections weekly or monthly depending on your needs. Once we’ve been able to evaluate the current cash situation, we can start looking to the future and anticipate future needs.

Strategize using scenarios we have gathered from our projections. If you need to make a purchase for a certain amount, we can make plans for when the best time to do that.

Our Blog – Read the latest tax news

Working at Home? Don’t Overlook These Deductions

August 7, 2020 ... Whether you claim a business office in the home or are simply working at home, say because of COVID-19, you likely have some former personal assets that you now use for business. If you thought new tax deductions, bingo! Say you don’t claim a...

PPP Loan Forgiveness Clarified for the Self-Employed

July 24, 2020 ... How much is clarity worth? And how much is making things easier worth? A whole lot! We now have both the new (a) clarity and (b) easy road to Paycheck Protection Program (PPP) loan forgiveness for the self-employed with no employees. Get ready to...

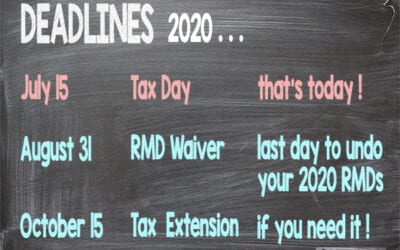

August 31: Last Day to Undo Your 2020 RMDs

July 15, 2020 ... Tax day is finally here, July 15! If you need more time, it's easy to get an automatic filing extension to October 15, and we can help you with that. But, there is another deadline coming up: August 31, 2020. For those of you who took out your...

What our Clients are saying

I’ve been to several accountants over the years, finally settling in with Legacy CPA. Hands down these guys are the best I’ve dealt with. Brian is very good at communicating and being proactive in helping me with my business. Highly recommend them.

Willie GinggBrian & Randy have been a pleasure to work with, they always go the extra mile to complete our taxes. I would highly recommend their services to anyone.

Barbara Clauson